Real Time Risk Solutions Founder Cory Davis on the unique position many businesses are in due to COVID-19 and how our platform can help:

“The COVID-19 outbreak has made business owners better understand the need for innovative insurance products to provide business interruption protection. The issue for many companies is that the pricing for these policies has prohibited companies from buying these products. There are ways to immediately decrease this price and make this more broadly available as an insurance offering,” says Davis.

There is now a direct way to catalog risks from Subject Matter Experts and provide an efficient way to gather critical real-time information back to the insurer in order to develop a more collaborative approach to navigate through underwriting, align interests, reduce risk and develop innovative focused insurance products.

The process involves gathering critical information from each company and ensuring that this information is provided in a structured format for insurance companies to price the risk consistently.

In times like these, where risk engineers are not able to be on-premise in order to help guide the insured on their risk decisions, it’s necessary to provide the framework that will allow each company to facilitate this information and provide remote access to the insurer to help them in this time of need. After all, we do not want to put the insurance company’s employees at risk, so remote information gathering is key.

Hindsight is 20/20 but there are already lessons gathered from COVID-19: companies should have adequate levels of PPE available to workers, in a place that is easily accessible and trained on the use; deep cleaning contracts need to be in place; a good communication plan should be developed and have a good way to get in contact with employees when they work remotely; there should be a well-developed work from home policy that can be quickly implemented with limited disruption to customers; essential functions should be categorized prior to outbreaks so that the business continues to operate; retainer agreements should be in place with contract and gig workers to fill in for absent workers; a process should be followed to adequately test employees when they are sick; supply chains should be constantly monitored to ensure that there are redundancy plans in place, and signage should be placed around the work environment about disease prevention strategies to name a few.

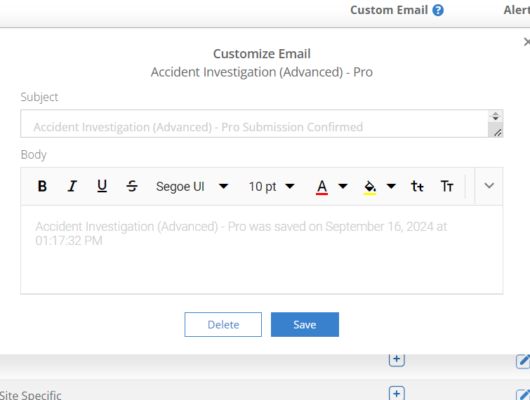

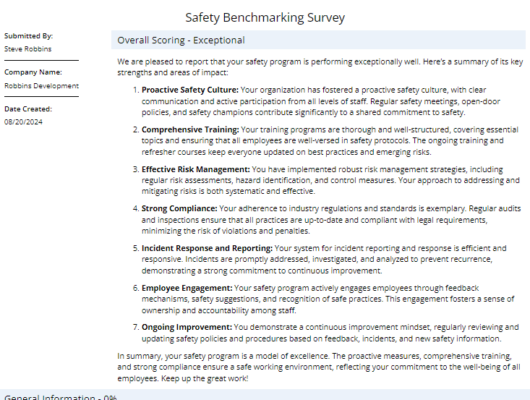

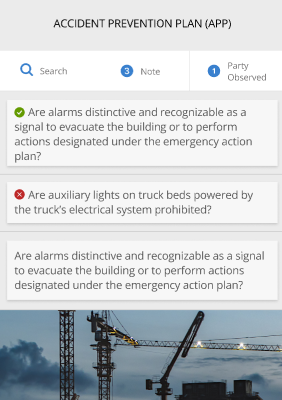

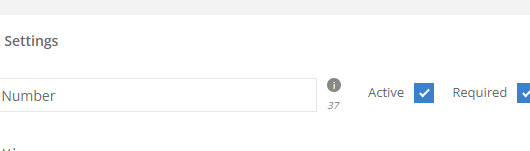

All of these things can be measured, tracked,and priced. Policies can be posted to an online file cabinet, controls can be measured and recorded with photos and notes, forms can be created and filled out remotely from anywhere to track critical information and training can be managed and documented.

That’s why we are working with insurance companies to already start thinking about how to make this process easier in the future. We determined that platforms are needed that enable insurers to very quickly broadcast news to its clients, implement controls, nd track documentation that is required in the policy to bind coverage,and codify warranties. This information can now be gathered without having to visit offices and further spread disease which is then integrated into existing RIMS systems to provide a real-time digital archive of risk data.

We are also developing safety meeting topics to guide companies on how to educate and train their employees. The platform allows each company to track and register each participant and provide tracking logs that can be managed across the organization to ensure that everybody is prepared.

Insurance companies can develop and implement targeted risk platforms within 48 hours to:

- Deploy a central risk management intelligence dashboard improving critical risk response activities and timelines for remote teams;

- Effectively benchmark pandemic key risk indicators to better manage enterprise-wide risk across multiple business silos;

- Establish real-time alerts and management of risk response activities improving overall response efficiency;

- Ensure real-time collaboration support, enabling risk management across the enterprise and overall risk value stream; and

- Provide a single source of current risk management data; stored in and accessed through a secure Cloud-Based SaaS Dashboard.

As they say in insurance “you don’t insure a house that’s on fire” so it’s too late for COVID-19 coverage, but it’s never too early to start thinking about what’s around the corner whether or not it’s a pandemic or the next unforeseen business interruption.

Written by Cory Davis